Did you know that 30% of operating small businesses are losing money? Running your own business is trickier than it sounds. You have to plan ahead carefully to break-even or be profitable in the long run.

Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

To start and sustain a small business it is important to know financial terms and metrics like net sales, income statement and most importantly break-even point.

Performing break-even analysis is a crucial activity for making important business decisions and to be profitable in business.

So how do you do it? That is what we will go through in this article. Some of the key takeaways for you when you finish this guide would be:

So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on.

Small businesses that succeeds are the ones that focus on business planning to cross the break-even point, and turn profitable.

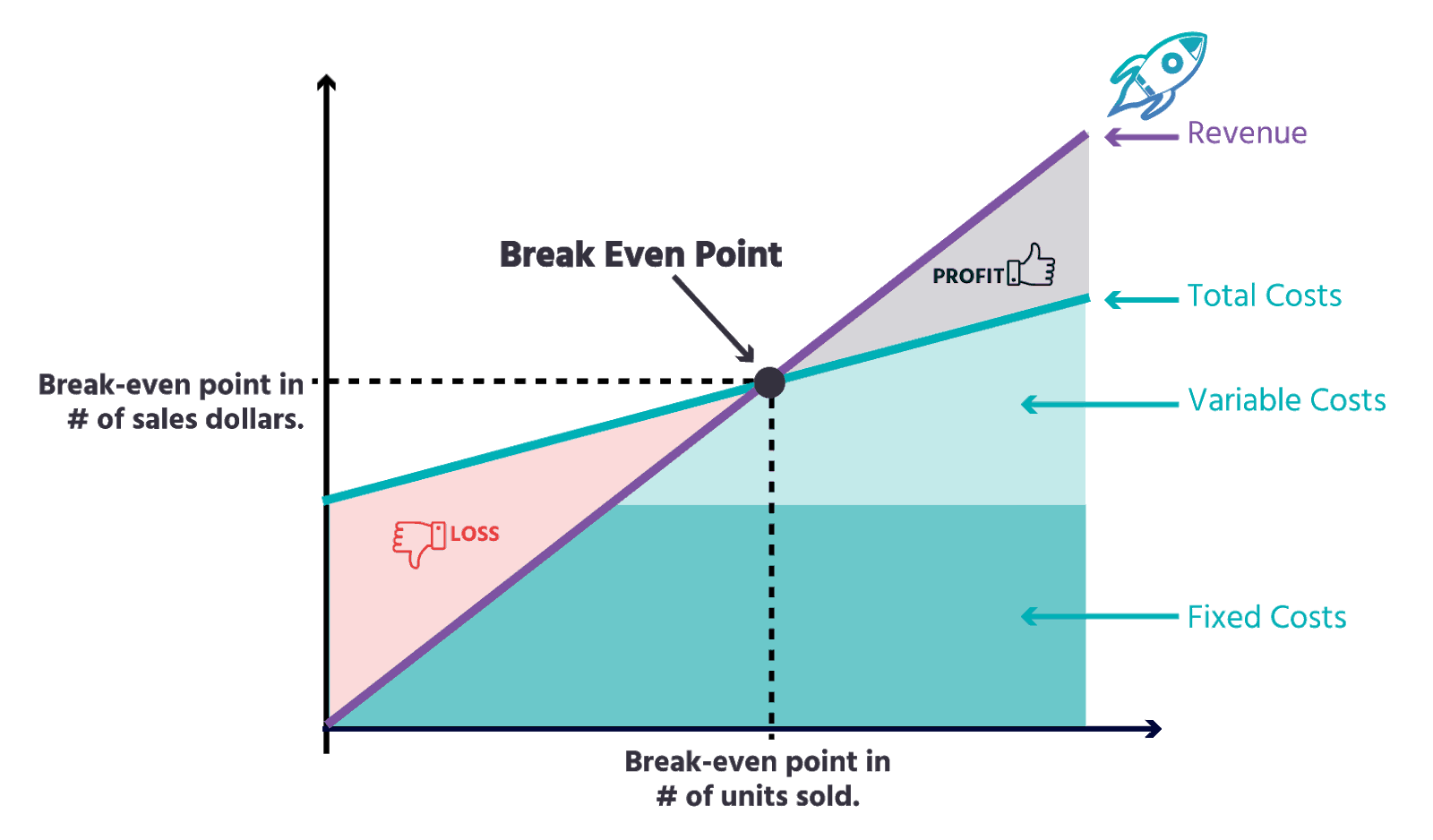

In a small business, a break-even point is a point at which total revenue equals total costs or expenses. At this point, there is no profit or loss — in other words, you 'break-even'.

Break-even as a term is used widely, from stock and options trading to corporate budgeting as a margin of safety measure.

On the other hand, break-even analysis lets you predict, or forecast your break-even point. This allows you to course your chart towards profitability.

Managers typically use break-even analysis to set a price to understand the economic impact of various price and sales volume calculations.

The total profit at the break-even point is zero. It is only possible for a small business to pass the break-even point when the dollar value of sales is greater than the fixed + variable cost per unit.

Every business must develop a break-even point calculation for their company. This will give visibility into the number of units to sell, or the sales revenue they need, to cover their variable and fixed costs.

A business could be bringing in a lot of money; however, it could still be making a loss. Knowing the break-even point helps decide prices, set sales targets, and prepare a business plan.

The break-even point calculation is an essential tool to analyze critical profit drivers of your business, including sales volume, average production costs, and, as mentioned earlier, the average sales price.

Using and understanding the break-even point, you can measure

There are multiple ways to calculate your break-even point.

One way to calculate the break-even point is to determine the number of units to be produced for transitioning from loss to profit.

For this method, simply use the formula below:

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

Fixed costs are those that do not change no matter how many units are sold. Don't worry, we will explain with examples below.

Revenue is the income, or dollars made by selling one unit.

Variable costs include cost of goods sold, or the acquisition cost. This may include the purchase cost and other additional costs like labor and freight costs.

Divide the fixed costs by the contribution margin. The contribution margin is determined by subtracting the variable costs from the price of a product. This amount is then used to cover the fixed costs.

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

Let’s take a deeper look at the some common terms we have encountered so far:

To show how break-even works, let’s take the hypothetical example of a high-end dressmaker. Let's assume she must incur a fixed cost of $45,000 to produce and sell a dress.

These costs might cover the software and materials needed to design the dress and be sure it meets the requirement of the brand, the fee paid to a designer to design the look and feel of the dress, and the development of promotional materials used to advertise the dress.

These costs are fixed as they do not change per the number of dresses sold.

The variable costs would include the materials used to make each dress — embellishment’s for $30, the fabric for the body for $20, inner lining for $10 — and the labor required to assemble the dress, which amounted to one and a half hours for a worker earning $50 per hour.

Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). If she sells the dress for $150, she’ll make a unit margin of $40.

Given the $40 unit margin she’ll receive for each dress sold, she will cover her $45,500 total fixed cost will be covered if she sells:

Break-Even Point (Units) = $45,000 ÷ $40 = 1,125 Units

You can see per the formula, on the right-hand side, that the Break-even is 1,125 dresses or units

In other words, if this dressmaker sells 1,125 units of this particular dress, then she will fully recover the $45,000 in fixed costs she invested in production and selling. If she sells fewer than 1,125 units, she will lose money. And if she sells more than 1,125 units, she will turn a profit. That’s the break-even point.

Suppose our dressmaker is worried about the current demand for dresses and has concerns about her firm’s sales and marketing capabilities, calling into question her ability to sell 1,125 units at a price of $150. What would be the effect of increasing the price to $200?

This would increase the unit margin to $90.Then the number of units to be sold would decline to 500 units.

With this information, the dressmaker could assess whether she was better off trying to sell 1,125 dresses at $150 or 500 dresses at $200, and priced accordingly.

Break-even analysis also can be used to assess how sales volume would need to change to justify other potential investments. For instance, consider the possibility of keeping the price at $150, but having a celebrity endorse the dress (think Madonna!) for a fee of $20,000.

This would be worthwhile if the dressmaker believed that the endorsement would result in total sales of $66,000 (the original fixed cost plus the $20,000 for Ms. Madonna).

With the Fixed Costs at $66,000 we see, it would only be worthwhile if the dressmaker believed that the endorsement would result in total sales of 1,650 units.

In other words, if the endorsement led to incremental sales of 525 dress units, the endorsement would break-even. If it led to incremental sales of greater than 525 dresses, it would increase profits.

Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good.

Imagine that our dressmaker could switch from using a rather plain $20 fabric for the dress to a higher-end $40 fabric, thereby increasing the variable cost of the dress from $110 to $130 and decreasing the unit margin from $40 to $20. How much would your sales need to increase to compensate for the extra cost?

Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). It would make better sense to switch to the nicer fabric if the dressmaker thought it would result in sales of 2,250 units, an additional 1125 dresses, which is double the number of initial sale numbers.

You likely aren’t a dressmaker or able to get a celebrity endorsement from Ms. Madonna, but you can use break-even analysis to understand how the various changes of your product, from revenue, costs, sales, impact your small business’s profitability.

Smart Pricing: Finding your break-even point will help you price your products better. A lot of effort and understanding goes into effective pricing, but knowing how it will affect your profitability is just as important. You need to make sure you can pay all your bills.

Cover Fixed Costs: When most people think about pricing, they think about how much their product costs to create. Those are considered variable costs. You will still need to cover your fixed costs like insurance or web development fees. Doing a break-even analysis helps you do that.

Avoid Missing Expenses: When you do a break-even analysis, you have to lay out all your financial commitments to figure out your break-even point. It’s easy to forget about expenses when you’re thinking through a business idea. This will limit the number of surprises down the road.

Setting Revenue Targets: After completing a break-even analysis, you know exactly how much you need to sell to be profitable. This will help you set better sales goals for you and your team.

Decision Making: Usually, business decisions are based on emotion. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to decide when you’ve put in the work and have useful data in front of you.

Manage Financial Strain: Doing a break-even analysis will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes by being aware of the risks and knowing when to avoid a business idea.

Business Funding: For any funding or investment, a break-even analysis is a key component of any business plan. You have to prove your plan is viable. It’s usually a requirement if you want to take on investors or other debt to fund your business.

If you’re thinking about a small online business or e-commerce, a break-even analysis is a must. Not only does it help you decide if your business idea is viable, but it makes you research and be realistic about costs, as well as think through your pricing strategy.

Especially for a small business, you should still do a break-even analysis before starting or adding on a new product in case that product is going to add to your expenses. There will be a need to work out the variable costs related to your new product and set prices before you start selling.

If you add a new sales channel, your costs will change. Let's say you have been selling online, and you’re thinking about opening an offline store; you’ll want to make sure you at least break-even with the brick and mortar costs added in. Adding additional marketing channels or expanding social media spends usually increases daily expenses. These costs need to be part of your break-even analysis.

Let's say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis. Your costs might vary significantly, and this will help you figure out if your prices need to change too.

So that's a wrap. Hope you found this article interesting and informative. Feel free to subscribe to our blog to get updates on awesome new content we publish for small business owners.

Break-even analysis is infinitely valuable as it sets the framework for pricing structures, operations, hiring employees, and obtaining future financial support.

Remember, any break-even analysis is only as strong as its underlying assumptions.

Like many forecasting metrics, break-even point is subject to it's limitations; however it can be a powerful and simple tool to provide a small business owner with an idea of what their sales need to be in order to start being profitable as quickly as possible.

Lastly, please understand that break-even analysis is not a predictor of demand.

If you go to market with the wrong product or the wrong price, it may be tough to ever hit the break-even point. To avoid this, make sure you have done the groundwork before setting up your business.

Head over to our small business guide on setting up a new business if you want to know more.

Want to calculate break even point quickly? Use our handy break-even point calculator.

Deskera featured posts

Hey 👋! Discover the best! Now!

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One.

Hey 👋! Discover the best! Now!

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One.